A rental agreement is a contract between a landlord and a tenant for leasing residential or commercial property.

These contracts outline the terms (rights and responsibilities) expected from both parties during the lease. Because a rental agreement is a contract, these terms are legally binding. A standard lease includes agreements on start date, end date, rent amount, rent due date, late fees, security deposit requirements, and more.

Types of Rental Agreements

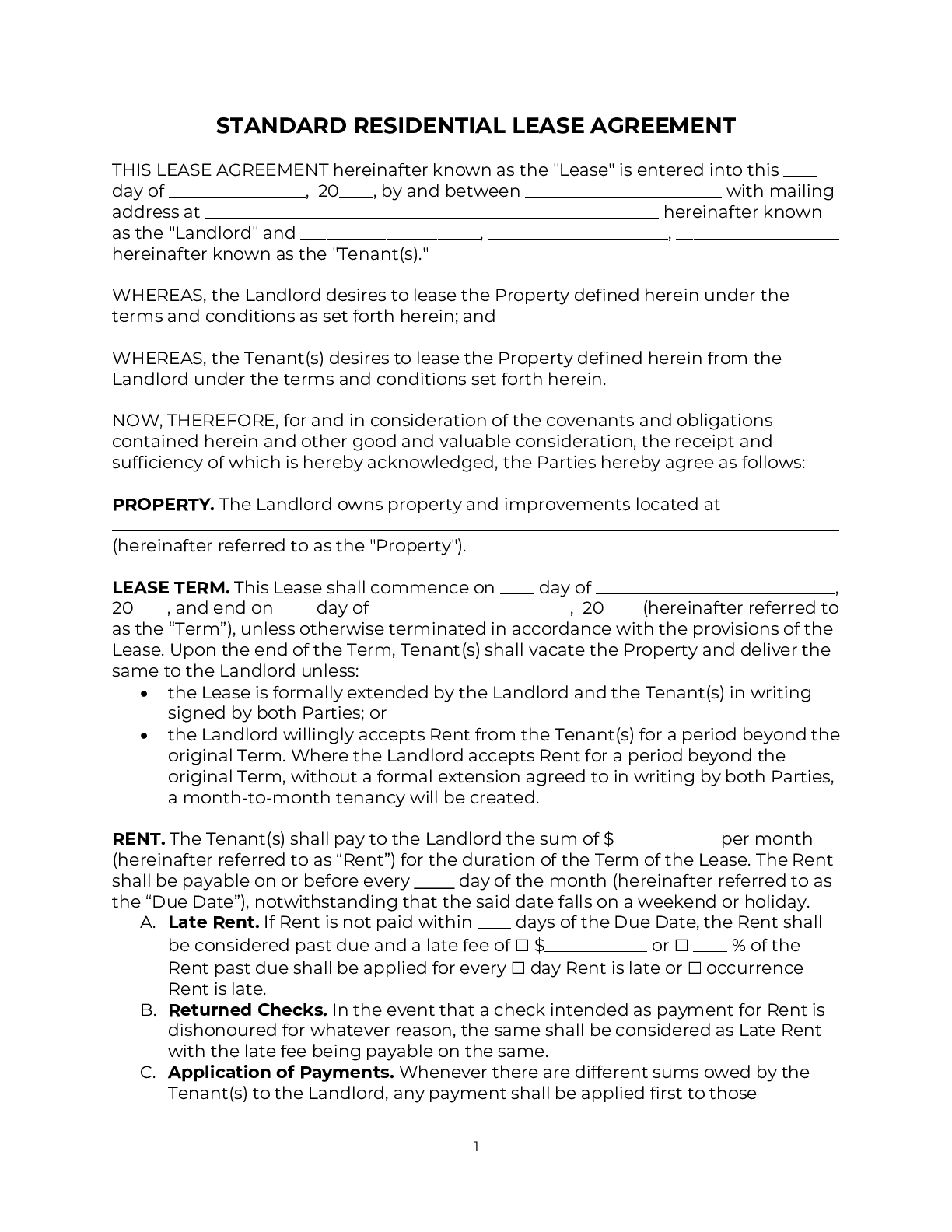

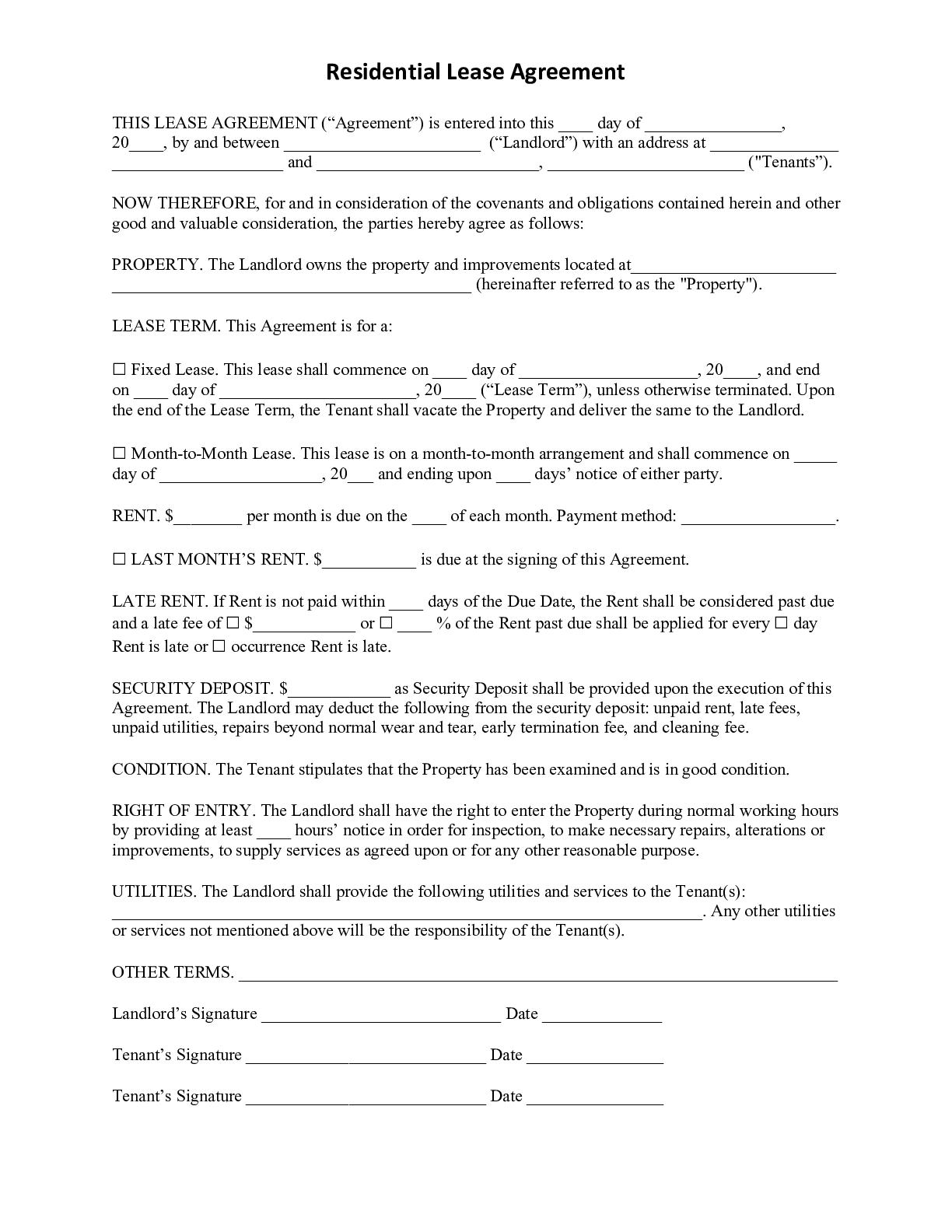

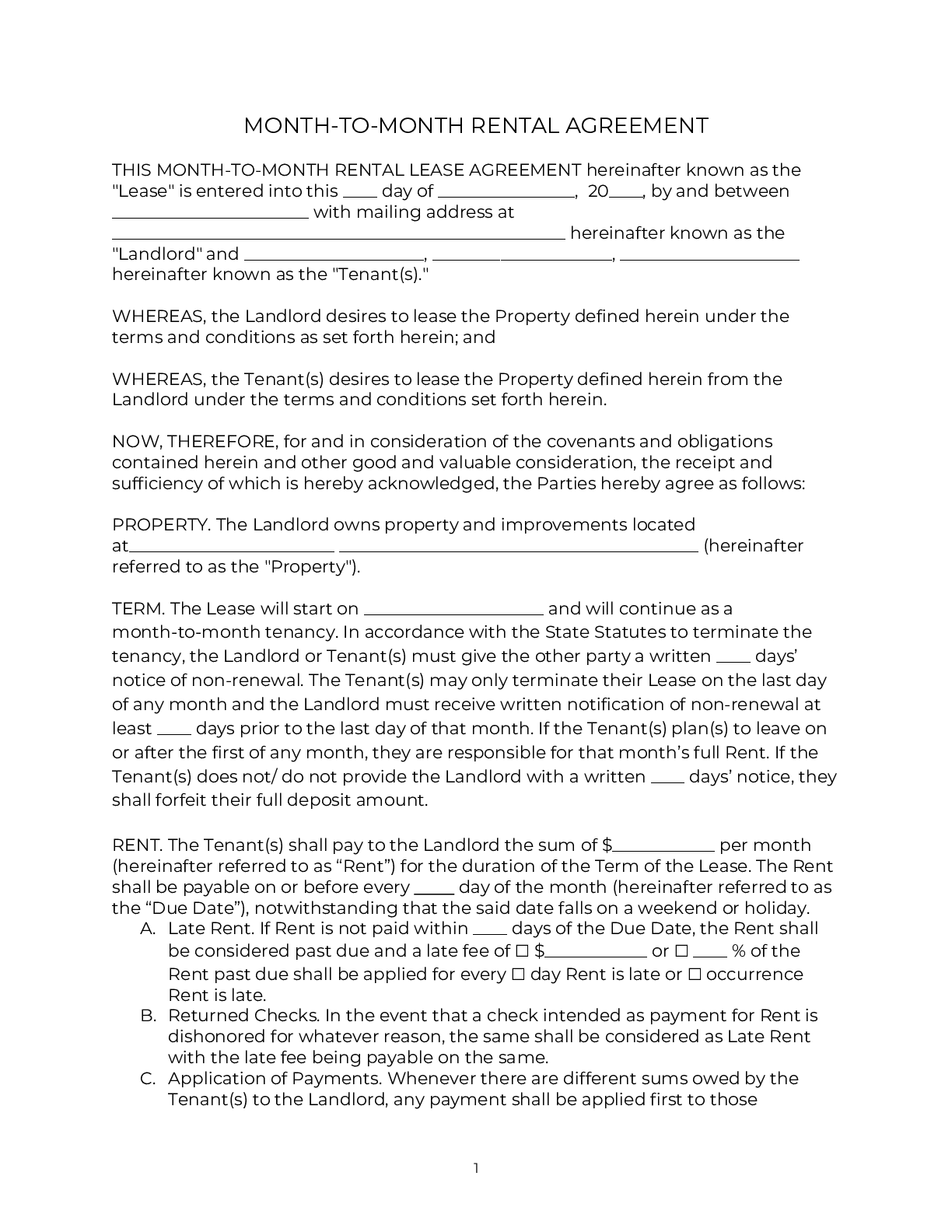

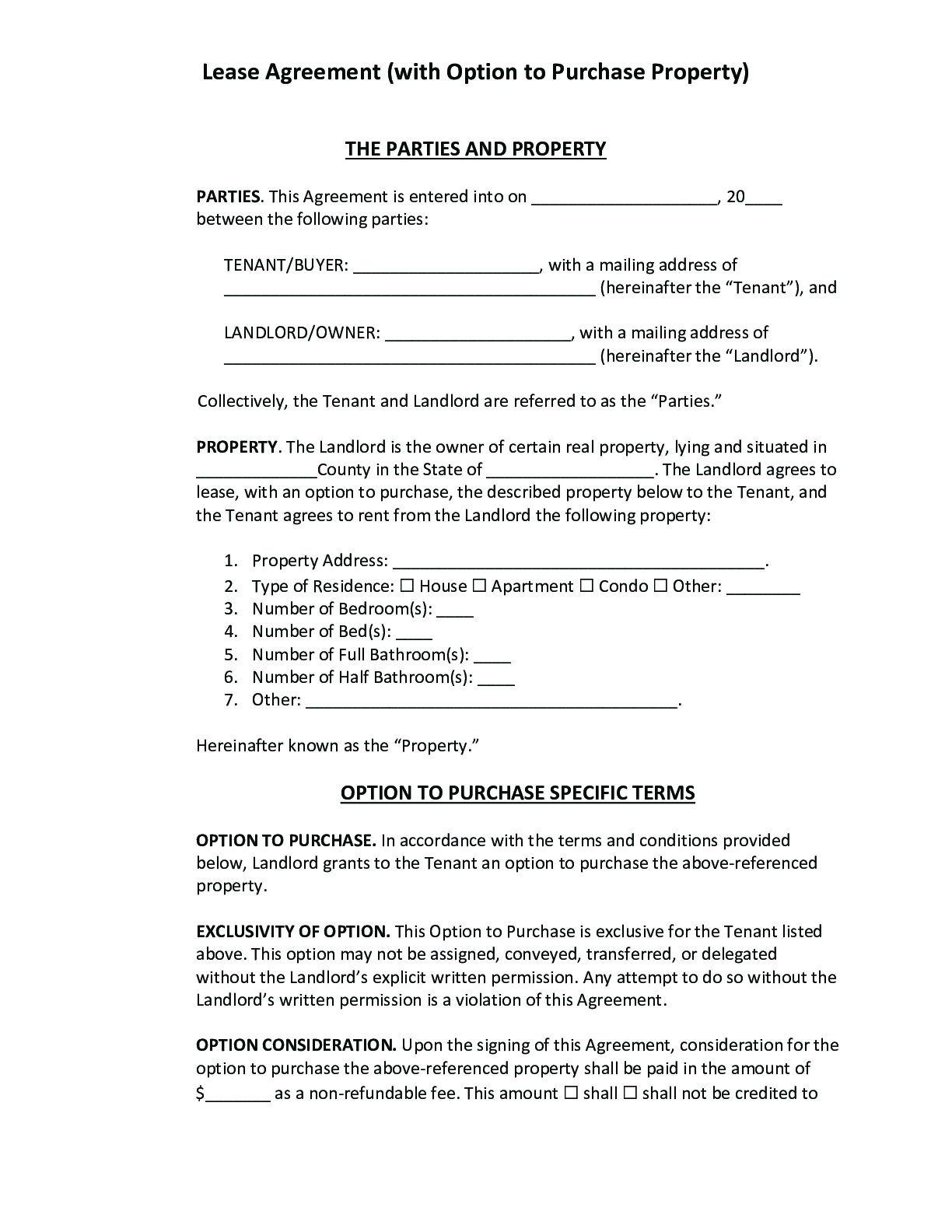

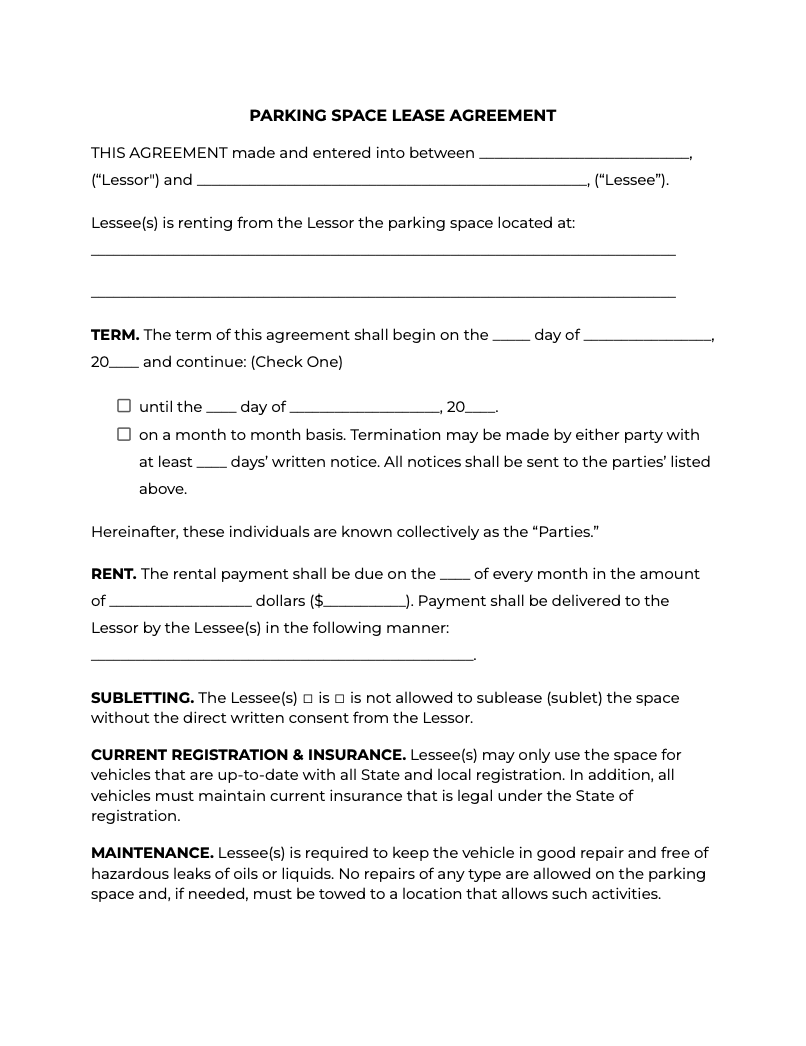

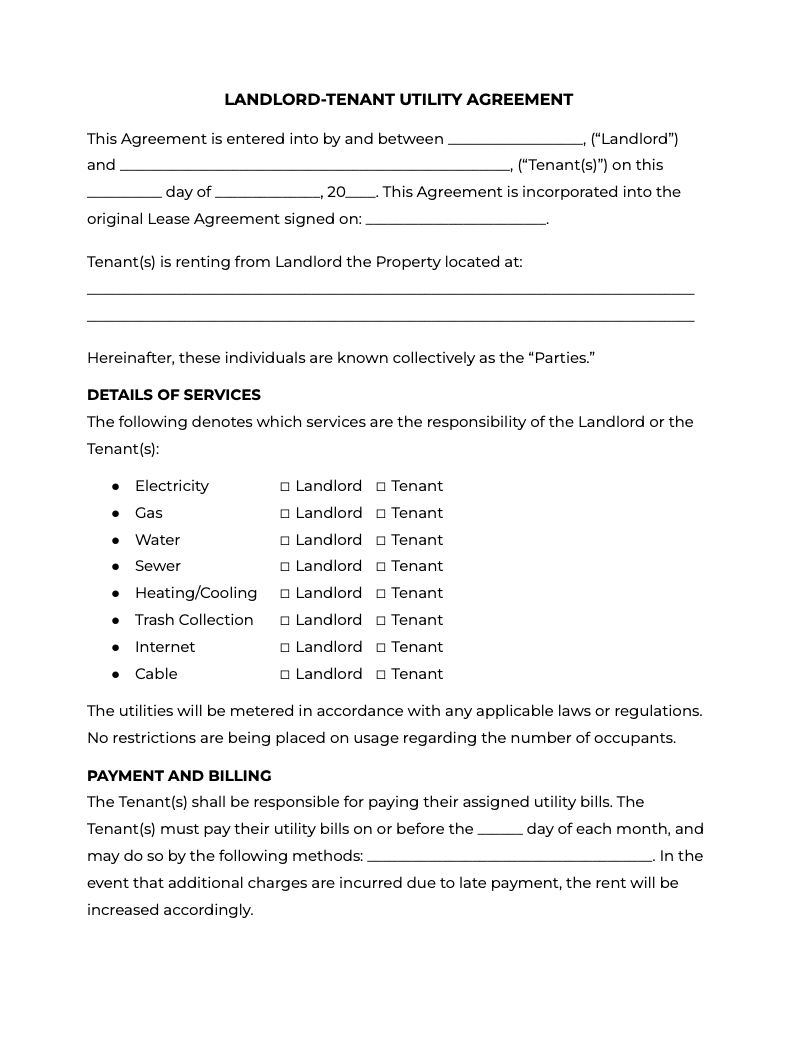

Landlords can choose from a variety of rental or purchase agreements based on their needs for the property:

Common Rental Agreement Addenda

Most rental agreements have a main agreement with the most important terms, plus some extra agreements (called addenda) which give special attention to a particular issue or disclosure. These are some of the most common types of addenda:

- Lead Paint Disclosure – A federal requirement for rental properties built before 1978. Discloses the presence of lead-based paint and provides a pamphlet detailing its dangers.

- Mold Addendum – Details the results of a mold inspection and defines the tenant’s responsibilities in preventing and reporting mold.

- Asbestos Disclosure Addendum – Details the asbestos status of a rental property. Not required by law, but provides peace of mind to tenants in older units and helps reduce potential landlord liability.

- Parking Rules Addendum – Details where a tenant and their guests can park, along with the number of vehicles which may be parked outside the rental unit.

- No Smoking Addendum – Outlines rules against smoking in or around the unit. May specify certain designated smoking areas.

- Smoke Detector and Carbon Monoxide Addendum – Clarifies responsibilities for maintaining and replacing detectors in the rental unit.

- Tenant Guest Policy Addendum – Outlines how many guests the tenant can have, and how long a guest can stay without being added to the lease.

- Residential Liability Waiver Addendum – Specifies that a landlord isn’t responsible for harm to tenants or guests, or damage to their personal belongings.

- Shared Utilities Agreement Addendum – Sets terms for how to divide utility costs up on properties which share a utility meter with other units.

Landlord-Tenant Laws

For a hassle-free rental experience, a landlord needs some understanding of state and local landlord-tenant laws. Different places set different rules for security deposits, raising rent, property entry, and more.

Maximum Security Deposits

Each state has its own rules about the legal maximum amount a landlord may collect for a security deposit:

| State | Maximum Security Deposit |

|---|---|

| Alabama |

|

| Alaska |

|

| Arizona |

|

| Arkansas |

|

| California |

|

| Colorado |

|

| Connecticut |

|

| Delaware |

|

| Florida |

|

| Georgia |

|

| Hawaii |

|

| Idaho |

|

| Illinois |

|

| Indiana |

|

| Iowa |

|

| Kansas |

|

| Kentucky |

|

| Louisiana |

|

| Maine |

|

| Maryland |

|

| Massachusetts |

|

| Michigan |

|

| Minnesota |

|

| Mississippi |

|

| Missouri |

|

| Montana |

|

| Nebraska |

|

| Nevada |

|

| New Hampshire |

|

| New Jersey |

|

| New Mexico |

|

| New York |

|

| North Carolina |

|

| North Dakota |

|

| Ohio |

|

| Oklahoma |

|

| Oregon |

|

| Pennsylvania |

|

| Rhode Island |

|

| South Carolina |

|

| South Dakota |

|

| Tennessee |

|

| Texas |

|

| Utah |

|

| Vermont |

|

| Virginia |

|

| Washington |

|

| Washington D.C. |

|

| West Virginia |

|

| Wisconsin |

|

| Wyoming |

|

Security Deposit Return Laws

Each state sets a different window of time for a landlord to return a tenant’s security deposit at the end of a lease:

| State | Deadline To Return Security Deposit |

|---|---|

| Alabama |

|

| Alaska |

|

| Arizona |

|

| Arkansas |

|

| California |

|

| Colorado |

|

| Connecticut |

|

| Delaware |

|

| Florida |

|

| Georgia |

|

| Hawaii |

|

| Idaho |

|

| Illinois |

|

| Indiana |

|

| Iowa |

|

| Kansas |

|

| Kentucky |

|

| Louisiana |

|

| Maine |

|

| Maryland |

|

| Massachusetts |

|

| Michigan |

|

| Minnesota |

|

| Mississippi |

|

| Missouri |

|

| Montana |

|

| Nebraska |

|

| Nevada |

|

| New Hampshire |

|

| New Jersey |

|

| New Mexico |

|

| New York |

|

| North Carolina |

|

| North Dakota |

|

| Ohio |

|

| Oklahoma |

|

| Oregon |

|

| Pennsylvania |

|

| Rhode Island |

|

| South Carolina |

|

| South Dakota |

|

| Tennessee |

|

| Texas |

|

| Utah |

|

| Vermont |

|

| Virginia |

|

| Washington |

|

| Washington D.C. |

|

| West Virginia |

|

| Wisconsin |

|

| Wyoming |

|

Rent Due Grace Periods

Most states let landlords charge a late fee the day after rent is normally due. The following states require a grace period before assessing late fees:

| State | Required Grace Period for Late Fees |

|---|---|

| Arizona |

|

| Colorado |

|

| Connecticut |

|

| Delaware |

|

| Maine |

|

| Massachusetts |

|

| Nevada |

|

| New Jersey |

|

| New York |

|

| North Carolina |

|

| Oregon |

|

| Tennessee |

|

| Texas |

|

| Virginia |

|

| Washington |

|

| Washington D.C. |

|

Late Rent Fee Maximums

Most states set a maximum for late rent fees. Even states without specific limits still can only charge “reasonable” amounts. “Reasonable” in most cases means no more than 10% of the rental amount, and must relate to the landlord’s actual costs.

| State | Maximum Late Rent Fee |

|---|---|

| Alabama |

|

| Alaska |

|

| Arizona |

|

| Arkansas |

|

| California |

|

| Colorado |

|

| Connecticut |

|

| Delaware |

|

| Florida |

|

| Georgia |

|

| Hawaii |

|

| Idaho |

|

| Illinois |

|

| Indiana |

|

| Iowa |

|

| Kansas |

|

| Kentucky |

|

| Louisiana |

|

| Maine |

|

| Maryland |

|

| Massachusetts |

|

| Michigan |

|

| Minnesota |

|

| Mississippi |

|

| Missouri |

|

| Montana |

|

| Nebraska |

|

| Nevada |

|

| New Hampshire |

|

| New Jersey |

|

| New Mexico |

|

| New York |

|

| North Carolina |

|

| North Dakota |

|

| Ohio |

|

| Oklahoma |

|

| Oregon |

|

| Pennsylvania |

|

| Rhode Island |

|

| South Carolina |

|

| South Dakota |

|

| Tennessee |

|

| Texas |

|

| Utah |

|

| Vermont |

|

| Virginia |

|

| Washington |

|

| Washington D.C. |

|

| West Virginia |

|

| Wisconsin |

|

| Wyoming |

|

When Can Landlords Raise Rent?

Landlords can’t raise rent during the term of a lease. They can raise rent at the end of a lease term. For instance, a landlord in most cases may raise the rent at the end of every month for a month-to-month rental agreement.

Some states have laws which limit how often a landlord can increase the rent:

| State | When Can a Landlord Raise Rent? |

|---|---|

| California |

|

| Colorado |

|

| Connecticut |

|

| Delaware |

|

| Idaho |

|

| Maine |

|

| Massachusetts |

|

| Michigan |

|

| Minnesota |

|

| New Jersey |

|

| New York |

|

| Oregon |

|

| Washington D.C. |

|

Landlord Entry Laws

Many states require a specific type and amount of advance notice to the tenant before a landlord can enter a rental property. Where there isn’t a specific law, the requirement is for “reasonable” advance notice, through any method which effectively communicates the reason and time for entry.

| State | Default Required Notice |

Allowed Notice Types | Possible To Waive Notice Requirements? |

| Alabama | 2 days | Any actual notice (the law prefers written posting on main door of the residence) | Yes (for scheduled services with a separate posted timeline) |

| Alaska | 24 hours | Any actual notice | No |

| Arizona | 2 days | Any actual notice | Yes (when addressing a tenant repair request) |

| Arkansas | “Reasonable” notice | Any actual notice | Yes |

| California | 24 hours for notice in person; 6 days for mailed notice | Written notice only (some special exceptions) | No |

| Colorado | “Reasonable” notice in general; 48 hours in some specific cases | Usually written, depends on entry purpose | Yes |

| Connecticut | “Reasonable” notice | Any actual notice | No |

| Delaware | 48 hours | Written notice only (but some actual notice may also count in court) | Yes (via separate written agreement before the start of the tenancy) |

| Florida | 24 hours for repairs; “reasonable” notice otherwise | Any actual notice | No |

| Georgia | “Reasonable” notice | Any actual notice | Yes |

| Hawaii | 2 days | Any actual notice | No |

| Idaho | “Reasonable” notice | Any actual notice | Yes |

| Illinois | “Reasonable” notice | Any actual notice | Yes |

| Indiana | 24 hours | Any actual notice | No |

| Iowa | 24 hours | Any actual notice | No |

| Kansas | “Reasonable” notice | Any actual notice | No |

| Kentucky

(KY-URLTA communities only) |

2 days |

|

No |

| Louisiana | “Reasonable” notice | Any actual notice | Yes |

| Maine | 24 hours | Any actual notice | No |

| Maryland | “Reasonable” notice | Any actual notice | Yes |

| Massachusetts | “Reasonable” notice | Any actual notice | No |

| Michigan | “Reasonable” notice | Any actual notice | Yes |

| Minnesota | “Reasonable” notice | Any actual notice | Yes (if a free agreement; CANNOT be a condition for signing or maintaining the lease) |

| Mississippi | “Reasonable” notice | Any actual notice | Yes |

| Missouri | “Reasonable” notice | Any actual notice | Yes |

| Montana | 24 hours | Any actual notice | No |

| Nebraska | 24 hours | Any actual notice | No |

| Nevada | 24 hours | Any actual notice | Yes (ONLY explicit waivers, ONLY covering a single entry at a time) |

| New Hampshire | “Reasonable” notice by default; 48 hours, for bedbug inspections |

|

No |

| New Jersey | 1 day | Any actual notice | Yes |

| New Mexico | 24 hours | Any actual notice | No |

| New York | “Reasonable” notice | Any actual notice | Yes (by agreement in the lease or other contract) |

| North Carolina | “Reasonable” notice | Any actual notice | Yes |

| North Dakota | “Reasonable” notice | Any actual notice (the law prefers written posting in/on the residence) | Yes |

| Ohio | “Reasonable” notice | Any actual notice | No |

| Oklahoma | 1 day | Any actual notice | No |

| Oregon | 24 hours | Any actual notice | Yes (detailed requirements which depend on the waiver’s purpose) |

| Pennsylvania | “Reasonable” notice | Any actual notice | Yes |

| Rhode Island | 2 days | Any actual notice | No |

| South Carolina | 24 hours | Any actual notice | No full notice waiver, BUT no notice requirement for some pre-announced services |

| South Dakota | 24 hours (customary; not strict legal requirement) | Any actual notice | Yes, BUT disfavored by law enforcement |

| Tennessee

(TN-URLTA counties only) |

“Reasonable” notice generally; 24 hours, for property showings | Any actual notice | No |

| Texas | “Reasonable” notice | Any actual notice | Yes |

| Utah | 24 hours (but tenants can’t sue if landlord fails to provide adequate notice) | Any actual notice | Yes |

| Vermont | 48 hours | Any actual notice | Yes |

| Virginia | 72 hours | Any actual notice | Yes (ONLY when addressing a tenant repair request) |

| Washington | 2 days in general; 1 day, for property showings | Written notice only | No |

| Washington DC | 48 hours |

|

Yes (ONLY in writing) |

| West Virginia | “Reasonable” notice | Any actual notice | Yes |

| Wisconsin | 12 hours | Written notice only, personally delivered to the tenant if possible | Yes (ONLY if written in a special lease addendum) |

| Wyoming | “Reasonable” notice | Any | Yes |

Rental Agreement FAQs

Here are some of the most common questions landlords ask about rental agreements:

Do I Need a Rental Lease Agreement?

Landlords must have a lease agreement with their tenants in order for it to be a legal business deal. This agreement almost always is in writing.

An oral agreement can be legally binding in some states, for a term of one year or less. Oral agreements are difficult to enforce, since any disagreement about terms is the landlord’s word against the tenant’s.

To avoid “he said, she said” disputes, the vast majority of landlords use written rental lease agreements.

Can Landlords Create Their Own Rental Agreements?

Landlords can create their own rental agreements.

Leases are complicated, so landlords often start with a template, set the most important terms to their liking, and then have a landlord-tenant attorney look over the agreement.

This lets the landlord use the same basic template for future rentals without having an attorney look it over each time.

What Information Should Be Included in a Rental Agreement?

Landlords should consider including the following information in every rental agreement:

- Contact info for everyone signing the lease (including names and addresses, at minimum)

- Address of the rental property

- Start and end date of the lease

- Amount of rent and security deposit, and when/how to pay them

- Other costs, such as utilities, HOA, internet, and more

- Scope and process for requesting repairs

- Lease rules, such as smoking, pets, number of vehicles, and more

- Guest rules, such as how long a guest can stay before they must be added to the lease

- Property condition checklist and expectations for conditions at the end of the lease

- Addendum for any relevant terms, such as mold, asbestos, or parking rules

- Signatures of the landlord and any adult tenants

For the most basic rental requirements, a landlord also can consider a simple lease that starts with just one page of information. The landlord can then add terms and conditions as needed.

Sources

- 1 Conn. Gen. Stat. § 47a-21(d)(2)

-

Upon termination of a tenancy, any tenant may notify the landlord in writing of such tenant’s forwarding address. Not later than twenty-one days after termination of a tenancy or fifteen days after receiving written notification of such tenant’s forwarding address, whichever is later, each landlord other than a rent receiver shall deliver to the tenant or former tenant at such forwarding address either (A) the full amount of the security deposit paid by such tenant plus accrued interest, or (B) the balance of such security deposit and accrued interest after deduction for any damages suffered by such landlord by reason of such tenant’s failure to comply with such tenant’s obligations, together with a written statement itemizing the nature and amount of such damages. Any landlord who violates any provision of this subsection shall be liable for twice the amount of any security deposit paid by such tenant, except that, if the only violation is the failure to deliver the accrued interest, such landlord shall be liable for ten dollars or twice the amount of the accrued interest, whichever is greater.

Source Link - 2 Conn. Gen. Stat. § 47a-15a(b)

-

Source Link

If a rental agreement contains a valid written agreement to pay a late charge in accordance with subsection (a) of section 47a-4, a landlord may assess a tenant such a late charge on a rent payment made subsequent to the grace period in accordance with this section. Such late charge may not exceed the lesser of (1) five dollars per day, up to a maximum of fifty dollars, or (2) five per cent of the delinquent rent payment or, in the case of a rental agreement paid in whole or in part by a governmental or charitable entity, five per cent of the tenant’s share of the delinquent rent payment. The landlord may not assess more than one late charge upon a delinquent rent payment, regardless of how long the rent remains unpaid.

- 3 Fla. Stat. § 83.808(3)

-

Source Link

A facility or unit owner may charge a tenant a reasonable late fee for each period that he or she does not pay rent due under the rental agreement. The amount of the late fee and the conditions for imposing such fee must be stated in the rental agreement or in an addendum to such agreement. For purposes of this subsection, a late fee of $20, or 20 percent of the monthly rent, whichever is greater, is reasonable and does not constitute a penalty. In addition to late fees, a facility or unit owner may also charge a tenant a reasonable fee for any expenses incurred as a result of rent collection or lien enforcement.